Hurricanes are a recurring source of suffering and stress on people and assets. Rightly so, insurance was invented to diminish the negative consequences on humans and businesses. Climate change has increased the frequency, violence and damage caused by storms. Accordingly, insurers see claim costs increase and policy holders experience higher premiums. Is there a way to stop or reduce this loose-loose downward spiraling cycle, and yet better serve customers?

H Insurance thinks so. If you have technology that can anticipate where the damage will happen, then you know what assets and customers will suffer. With that knowledge you can focus, take preventive actions and accurately estimate future claims.

That technology is Location Analytics and it is delivered by Galigeo since 2001. It is directly connected to customer and weather data sources, and it is simple to use, you do not need to be an expert.

Damage estimates

During September 2018, Hurricane Florence hit the California coast. Behind it, the meteorological phenomenon left more than $38 billion in damage and a real brain teaser regarding management for insurers.

Last year, not less than $144 billion in losses were borne by insurers around the world in the past year.

Experts say that 2020 Hurrican season will be one of the most active seasons on record.

We cannot stop hurricanes from happening, but we can certainly prepare. Expert services like those provided by NOAA are central to foretell at a macro level. But locally, at a business level, what more can we do with this valuable information?

What if companies could optimize costs and claims management with Location Analytics? Example with H Insurance.

Focus, prevent and estimate impact with Location Analytics

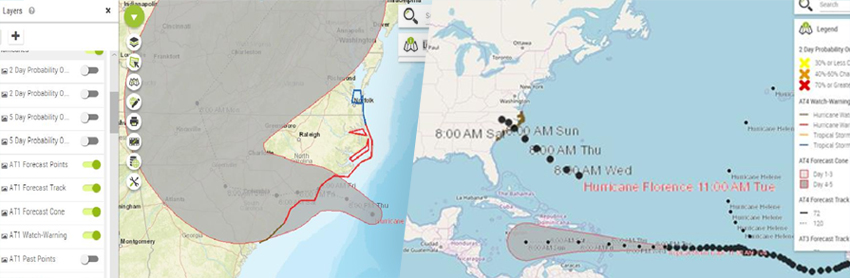

Using Galigeo Location Analytics solutions, H Insurance is able to overlay NOAA’s predicted hurricane trajectory and intensity with their customer locations. The resulting map dynamically displays customers risk levels by areas.

Clients can receive precautionary instructions, for example, to move assets (i.e., trucks, machinery, etc.) to higher grounds. This real-time information is key to improving safety, minimizing cost, while allowing business to continue safely in unaffected areas, because false-positives are also a source of cost and unnecessary stress. Insured clients will appreciate.

“Location Analytics allows us to quickly define which customers will be impacted, and what the damage costs will be.” says Tamy, BI Analyst at H Insurance

Ranking claims and detecting fraud

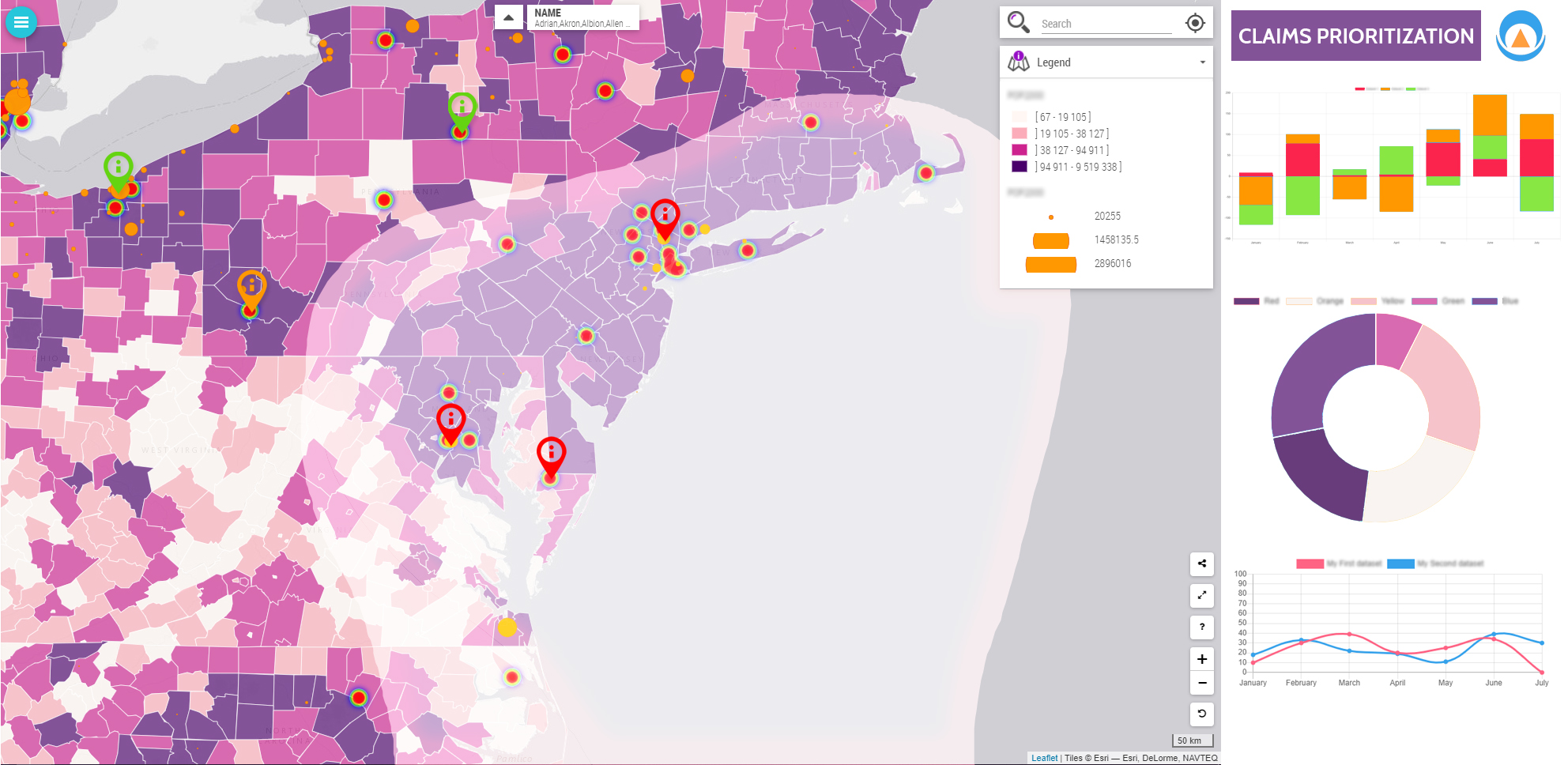

Using Location Analytics insurers, like H Insurance, are able to prioritize claims on the basis of data analysis.

By looking at hurricane paths with different indicators (weather, severity, water levels, wind strength, …) alongside customer data, such as type of home, customer policy coverage, and more, insurers are able to rank claim orders. These are sound data-driven decisions.

But H Insurance does more, because they also detect non hurricane-related claims, and trigger further investigations to limit false claims or opportunistic behaviors.

With faster, more precise and fairer compensations, it results in an improved quality of service for policyholders before, during and after the event.

Managing natural disasters, beyond insurers

Insurers are not the only ones who can take advantage of Location Analytics to anticipate risks. Another example would be any company where one of its factories is threatened by floods, fire or debris.

Thanks to mapping overlays organizations can launch the necessary logistical actions upstream and thus limit the damage. This is a an essential feature in times of climate change.